Los Angeles Bankruptcy Tax

What We Do

Our Firm specializes in bankruptcy tax matters in the Central District of California. We handle bankruptcy cases with tax issues in Los Angeles, Riverside, Santa Ana, Santa Barbara, and the San Fernando Valley.

Advise debtors and bankruptcy counsel on tax issues in chapter 7, chapter 11, and chapter 13 cases.

Counsel debtors and bankruptcy attorneys on IRS enforcement actions inside and outside of bankruptcy such as federal tax liens, seizures, and sales of assets.

Provide pre-bankruptcy tax strategies for individuals and business entities considering bankruptcy.

Represent debtors in chapter 7, chapter 11, and chapter 13.

Handle contested matters and bankruptcy litigation involving the Internal Revenue Service and the state taxing agencies such as the California Franchise Tax Board, California Employment Development Department, California Department of Tax and Fee Administration.

FAQs on bankruptcy tax

Can back taxes be discharged in bankruptcy? Does bankruptcy clear tax debts?

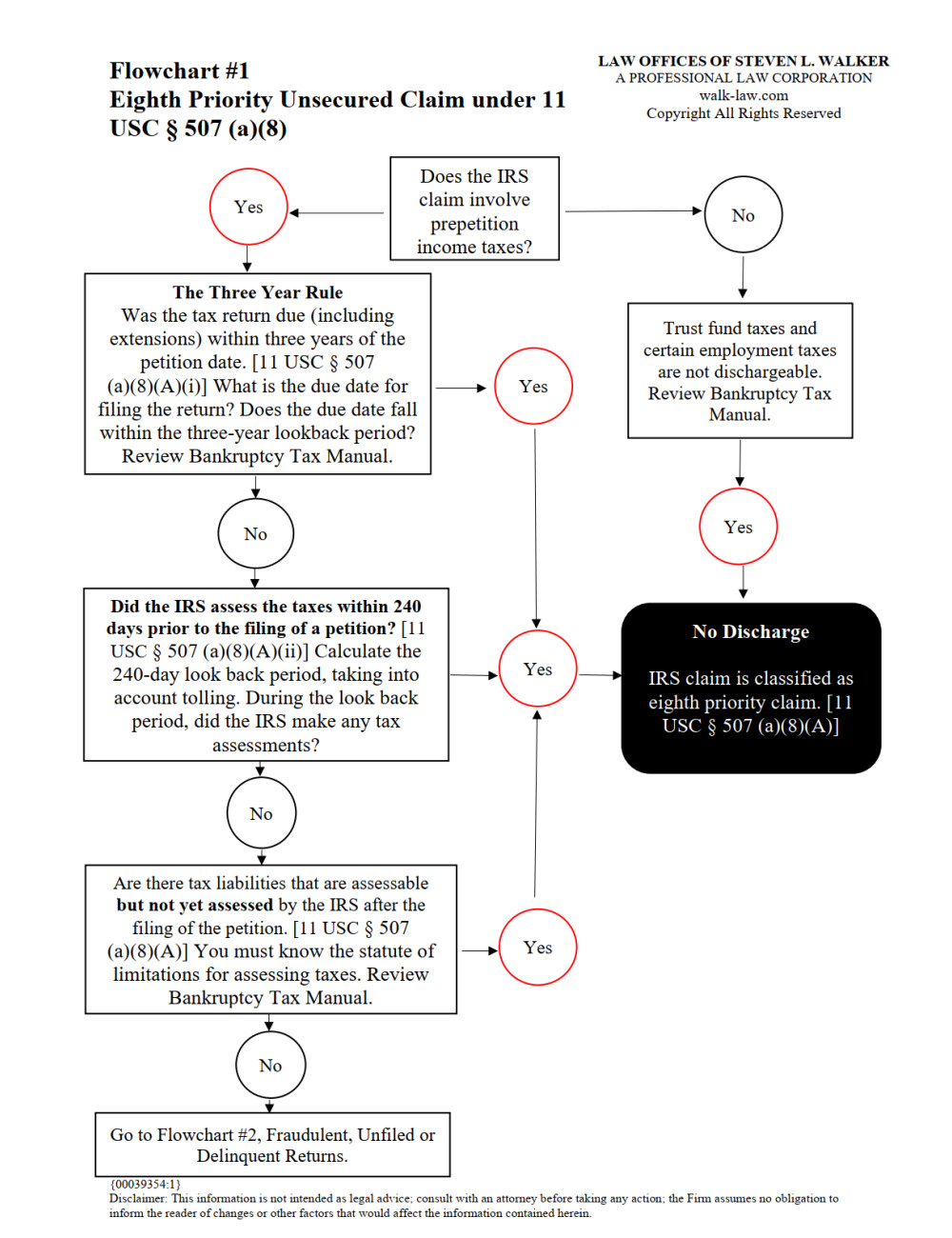

Yes, under certain circumstances, a debtor can discharge taxes in bankruptcy, and the bankruptcy will clear past tax liabilities. However, if the taxes are considered 8th priority taxes, the taxes will not be discharged, and so debtor’s counsel must evaluate the case and determine whether any of the tax liabilities qualify as 8th priority taxes.

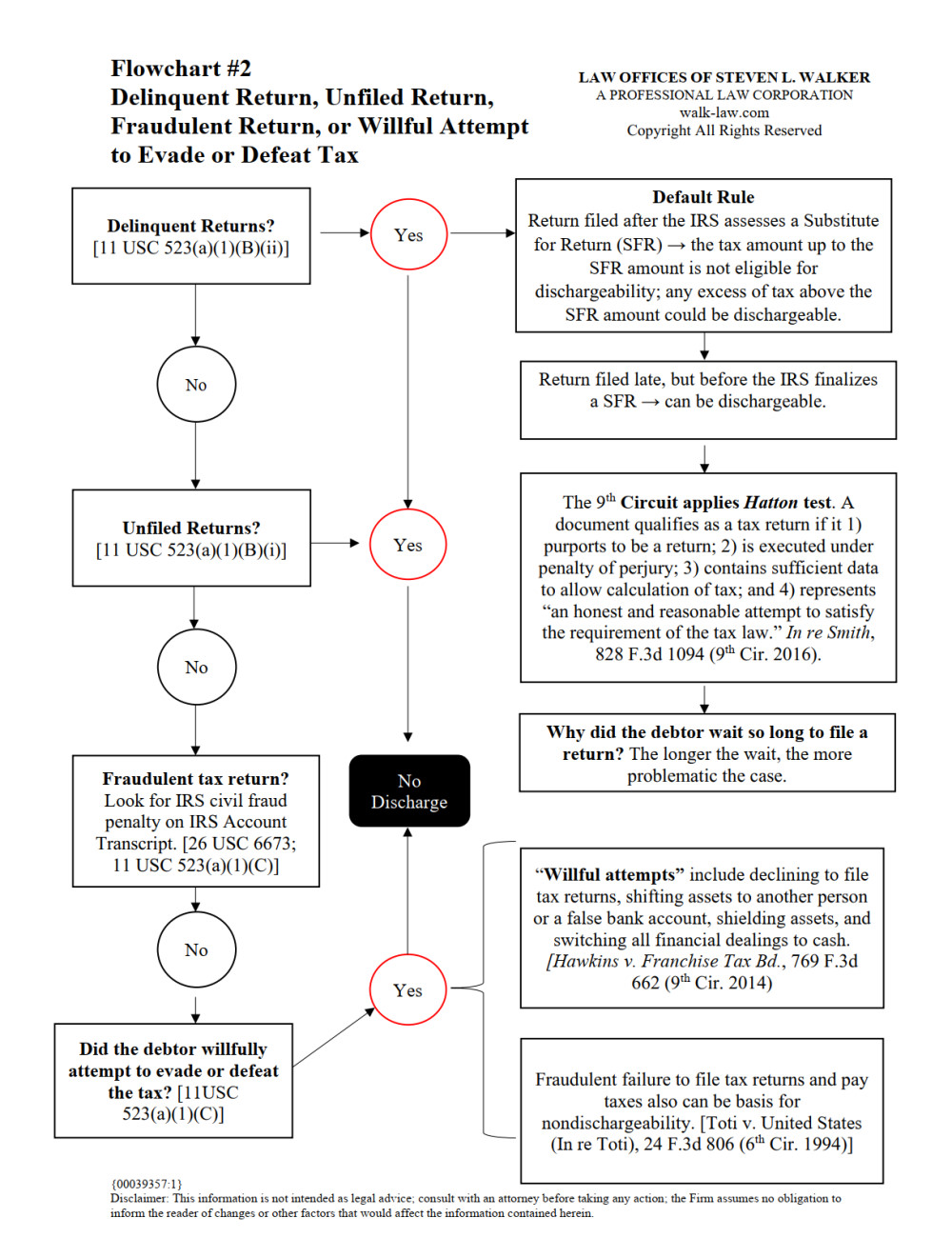

In addition, if the debtor filed a fraudulent return, or has unfiled tax returns, the taxes will not be discharged. If the debtor filed delinquent returns (late returns), the taxes may or may not be discharged, depending upon the facts of the particular case.

Can an IRS debt be discharged in Chapter 7?

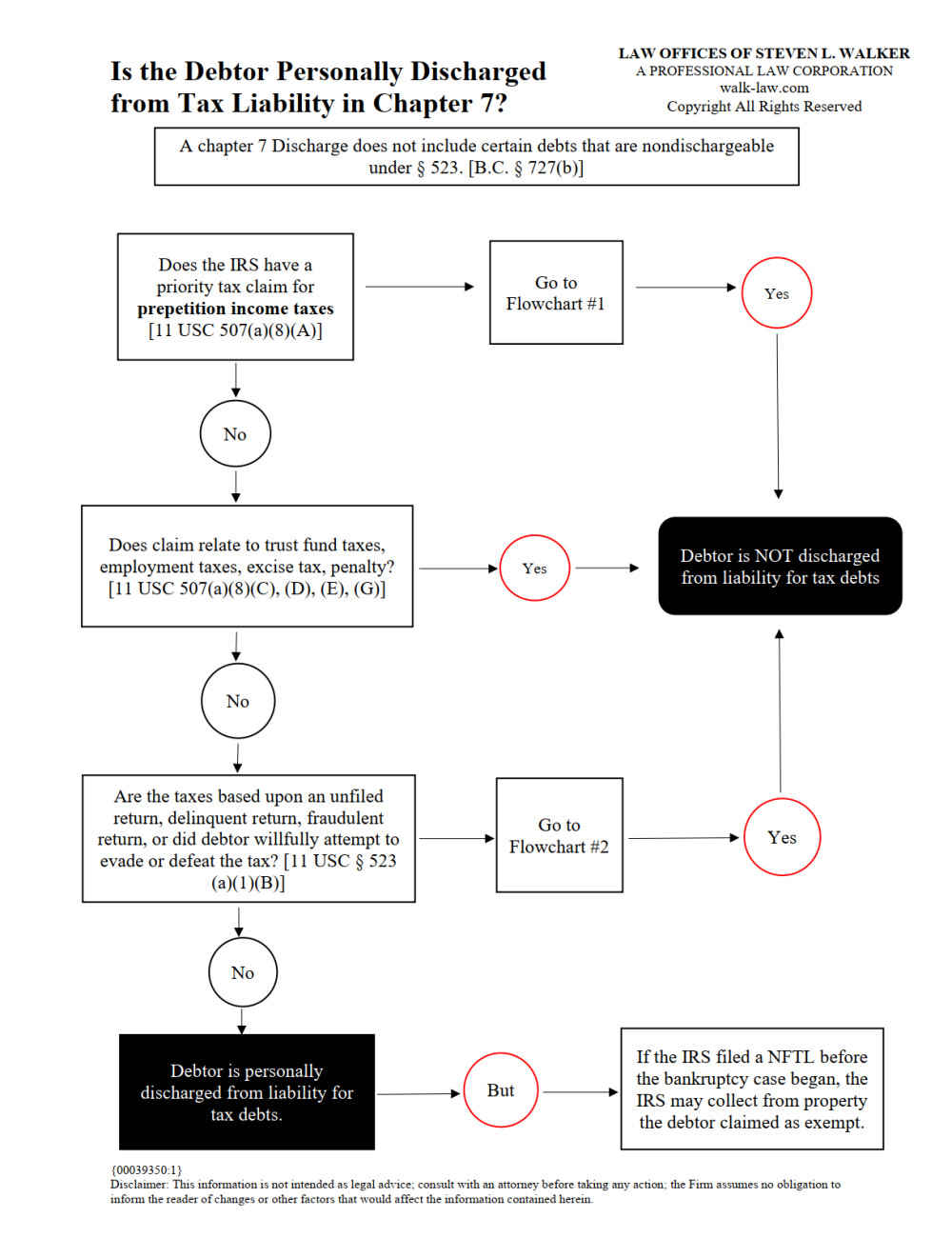

A Chapter 7 discharge does not include certain debts that are nondischargeable under § 523. [11 USC § 727(b)]

Section 523(a) sets forth the exceptions to a discharge in a Chapter, 7, Chapter 11, and a hardship discharge under Chapter 13. [11 USC § 523(a), § 1141(d)(2), § 1328(b)].

• Eighth Priority Taxes. For a tax of the kind specified in § 507(a)(8), whether or not the debtor filed a return or filed the return late. [11 USC § 523(a)(1)(A)]

• Unfiled Tax Returns. [11 § USC 523(a)(1)(B)(i)]

• Late-Filed Returns. For a tax with respect to which a return, or equivalent report or notice, if required was not filed, or was filed after the due date, and after two years before the date of the filing of the petition. [11 § USC 523(a)(1)(B)(ii)]

• Fraudulent Returns. For a tax with respect to which the debtor made a fraudulent return or willfully attempted in any manner to evade or defeat the tax. [11 USC § 523(a)(1)(C)]

The rules are complex and debtors with tax issues should contact competent tax counsel, who can review the facts of the case and determine the chances of discharging taxes in bankruptcy.

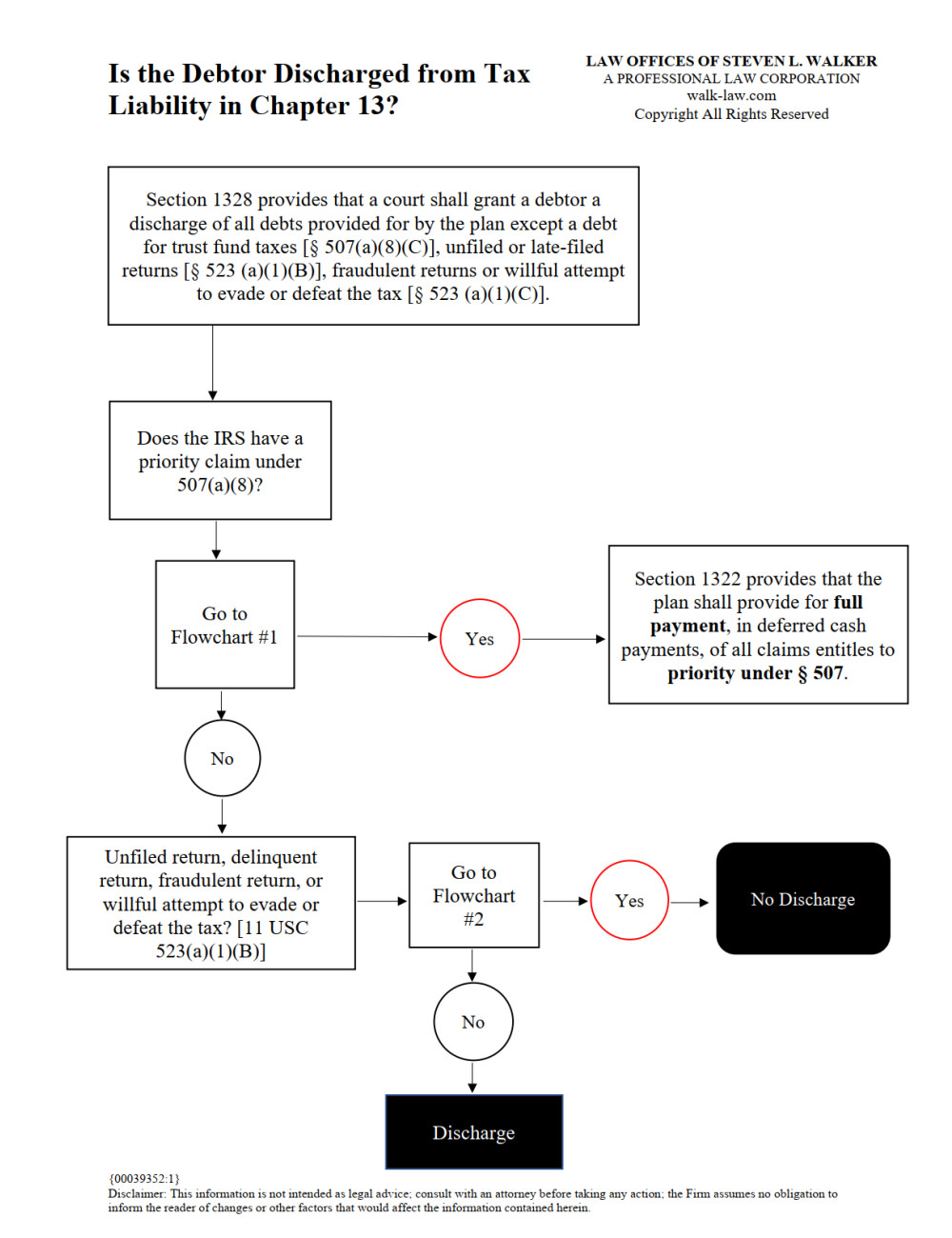

Can IRS debt be discharged in Chapter 13?

11 USC §1322 provides that a Chapter 13 plan shall provide for full payment, in deferred cash payments, of all claims entitled to priority under § 507. This means that you must determine whether the IRS has a priority claim and if so, the plan must full pay the balance due.

What are priority taxes? Section 507(a)(8) provides that certain allowed unsecured claims of governmental units (e.g., IRS, Franchise Tax Board, California Department of Tax and Fee Administration) are entitled to eighth priority. These unsecured claims include the following:

• Prepetition priority income taxes or gross receipt taxes

• Property taxes

• Trust fund or withholding taxes

• Employment taxes

• Excise taxes

• Penalty related to a tax claim and in compensation for actual pecuniary loss

Priority claims generally are the first unsecured claims to be paid in a bankruptcy case following distribution to secured creditors.

Are state taxes dischargeable in Chapter 7?

Yes, state taxes can be discharged in a Chapter 7 case if certain conditions are satisfied.

How do I read an IRS proof of claim?

The IRS enters a bankruptcy case and “frames” its case by filing a Proof of Claim for Internal Revenue Taxes. It is important to know how to read and understand the IRS Proof of Claim, and below are a few key things to know.

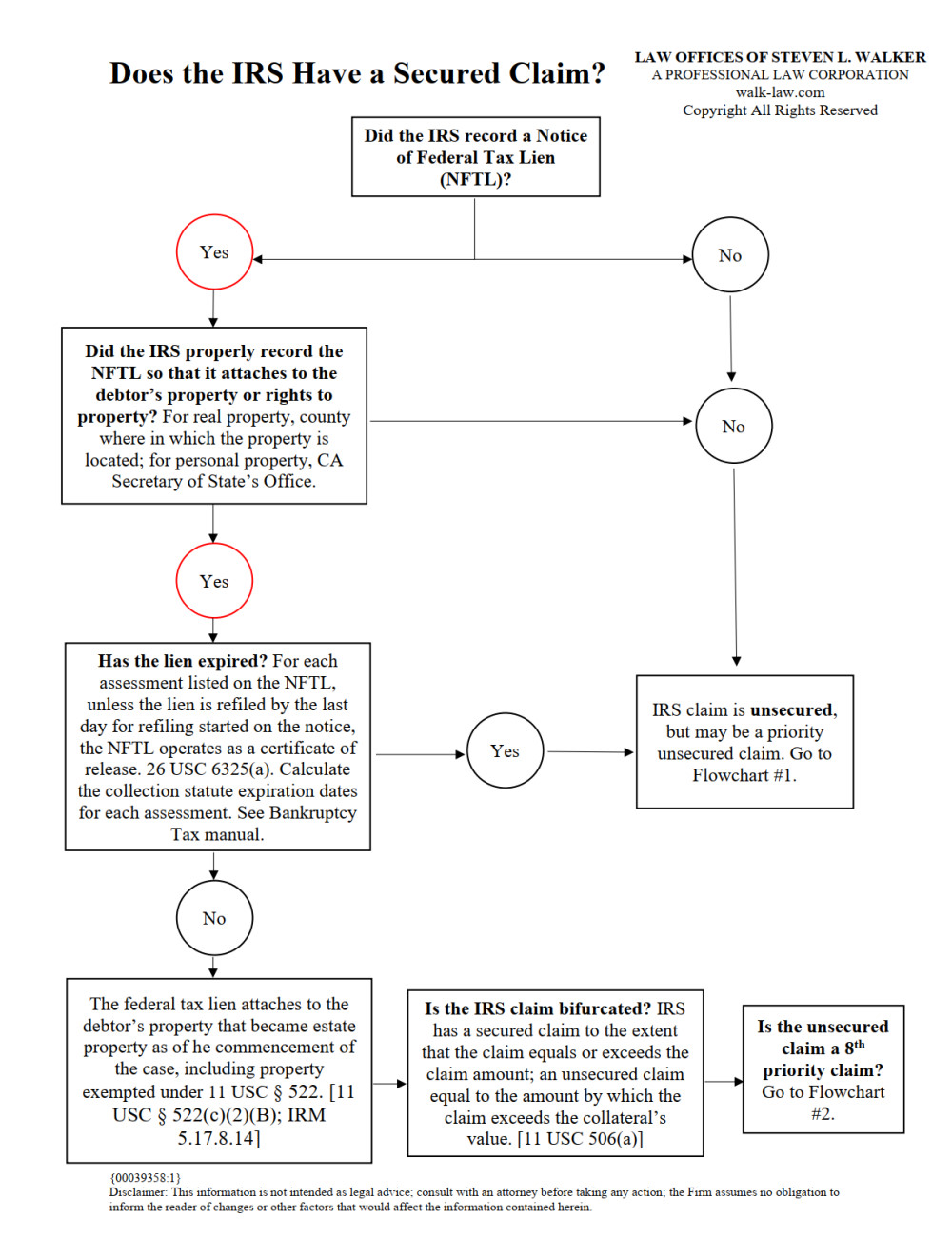

The claim tells you whether the IRS’ claim is secured, meaning that the IRS has filed a notice of federal tax lien, or is unsecured. The lien also tells you the kind of tax owed, such as income taxes, the tax due, and the date when the IRS filed a notice of federal tax lien.

Refer to the Bankruptcy Tax Manual on our website for a detailed discussion of how to read an IRS Proof of claim.

Practice Tip. If the IRS has filed a proof of claim, the debtor should determine whether the IRS properly filed a Notice of Federal Tax Lien (NFTL). Do not assume that the IRS properly filed the NFTL. If the IRS failed to file the NFTL properly, the IRS has an unsecured claim. In addition, a debtor should determine whether the tax lien has expired because a lien generally only lasts ten years.

What happens to an IRS federal tax lien in bankruptcy?

If the IRS has filed a valid Notice of Federal Tax Lien prior to the debtor filing bankruptcy, the lien “rides through” the bankruptcy and attaches to the debtor’s property.

The IRS can actually take enforcement action after a debtor receives a discharge if the IRS has filed a valid NFTL and there are exempt, abandoned, or excluded assets.

Example. Retirement Accounts and Exempt Assets

Debtor owes $100,000 to the IRS and also has a retirement account at Fidelity Investments. The debtor files a Chapter 7, claims the retirement account as an exempt asset, and receives a discharge. Four months later, the IRS contacts the debtor and says that it plays to take collection action against the retirement account. Can the IRS do this even though the debtor received a discharge? The answer is yes so long as the IRS properly filed a notice of federal tax lien prior to bankruptcy. The lien “rides through” bankruptcy.

Example. House with Equity and Homestead Exemption

A similar example occurs where the debtor owns a home and claims a portion of the equity as exempt under the homestead exemption. If the IRS filed a valid NFTL prior to bankruptcy, the IRS can take enforcement action outside of bankruptcy, even though the debtor discharged the taxes.

Debtors facing collection action post-bankruptcy should contact competent tax counsel, who can review the situation and provide proper advice.

What is the three-year rule?

The three-year rule is one of the rules that determine whether prepetition income taxes or gross receipt taxes (think sales taxes) can be discharged in bankruptcy. If the IRS or state taxing agency satisfies the three-year rule, the taxes are considered priority taxes and not dischargeable.

The three-year rule essentially provides that the required tax return was last due (including extensions) within three years of the petition date [11 USC § 507(a)(8)(A)(i)].

To determine whether an unsecured tax claim qualifies under the three-year rule, ask the following questions:

• What is the due date for filing the return?

• What is the three-year lookback period?

• Does the due date for the return fall within the lookback period?

What is the 240-day rule in bankruptcy?

The 240-Day Rule is another rule that helps determine whether prepetition income taxes or gross receipt taxes (think sales taxes) can be discharged in bankruptcy. If the IRS or state taxing agency satisfies the 240-Day Rule, the taxes are considered priority taxes and not dischargeable.

Even if the governmental unit passes the Three-Year Rule, the tax claim nevertheless may be classified as an eighth priority if the claim satisfies the 240-Day Rule.

Any income taxes and gross receipts taxes assessed within 240 days prior to the filing of a petition will be classified as eighth priority, nondischargeable tax liabilities in Chapter 7 and 11. [11 USC § 507(a)(8)(A)(ii)]

To figure out whether the IRS passes the 240-Day Rule, follow the following analysis:

• Calculate the 240 Day lookback period from the petition’s filing date, considering any tolling.

• During the 240-day lookback period, determine whether the governmental unit made any tax assessments.

Can I litigate my tax case in bankruptcy court?

If a debtor has a federal tax liability and the debtor thinks that he or she does not actually owe the balance due, the debtor may want to consider asking the bankruptcy court to determine the amount legally owed to the Internal Revenue Service or a state taxing agency such as the California Franchise Tax Board.

The Bankruptcy court may determine the amount or legality of any tax, fine or penalty, whether or not the IRS has not assessed the taxes or the taxes were paid. [11 USC 505(a)(1)]

In some situations, however, the bankruptcy court lacks jurisdiction to determine the balance due to the IRS. The court may not determine the amount of a tax, fine or penalty if such amount or legality was contested before and adjudicated by a judicial or administrative tribunal of competent jurisdiction before the commencement of the case under this title.” [11 USC 505(a)(2)]

Consequently, if the Tax Court has already decided the issue, the debtor cannot re-litigate the case in Bankruptcy Court.

Example 1. Tax Court Litigation

Taxpayer files a petition in U.S. Tax Court and the Court decides the issue. The debtor can not file bankruptcy and re-litigate the issue in bankruptcy court.

Example 2. Taxpayer Defaults on Notice of Deficiency

The IRS issues a notice of deficiency, and the taxpayer failed to timely file a petition in Tax Court within 90 days and therefore defaulted on the notice. The taxpayer nevertheless can litigate the tax issue in Bankruptcy Court, and the taxpayer does not need a new notice of deficiency to litigate the case. The bankruptcy court has jurisdiction to hear the matter.

In summary, if the Tax Court has already decided the issue, a taxpayer cannot re-litigate the case in bankruptcy court. Moreover, a taxpayer does not need a need a notice of deficiency or collection due process rights to bring the action in bankruptcy court. IRS files a claim and the debtor files an objection. The bankruptcy court has broad authority to hear the tax case. A bankruptcy court is simply another way for a debtor to resolve a tax dispute that the debtor was unable to do in an audit, before the U.S. Tax Court, or in a collection due process hearing. It is almost like a second or third bite at the apple.

Debtors with a balance due to the IRS or a state taxing agency and who think that they owe a lessor amount should contact competent tax counsel, who can advise a proper strategy for handling the case.

When can a late-filed tax return be discharged?

What if an individual files a tax return after the due date for filing the return. Can the individual later file a Chapter 7 and discharge the tax liability relating to the late-filed return? In California, the answer is not always so clear. Here are some basic guidelines.

If the debtor is located in California, and the debtor files a return after the IRS prepares a substitute for return (SFR), the tax liability up to the SFR amount is not eligible for dischargeability; any excess of tax above the SFR amount could be dischargeable.

An important case to ready on the dischargeability of late-filed tax returns in California is Smith v. United States IRS (In re Smith), 2016 U.S. App. LEXIS 12859 (9th Cir. July 13, 2016).

If the debtor files the return late, but before the IRS finalizes, a SFR, the taxes can be dischargeable.

This is a complex area of the law, and individuals facing this situation should contact competent tax counsel, who can evaluate the facts and circumstances of the case.

Can tax penalties be discharged in bankruptcy?

Yes, in certain circumstances, a tax penalty can be discharged in bankruptcy. The general rule is that if the taxes are discharged for a particular tax year, the penalties associated with the tax liability are also discharged for that tax year.

Example. Sally files a Chapter 7 and receives a discharge of her federal income tax liability for the tax year 2015. The civil penalties associated with the tax liability are also discharged.

Here is the more technical rule. Tax penalties are dischargeable if the penalty relates to a tax liability that does not fall within the exception to discharge under § 523(a)(1) (gap taxes, 8th priority taxes, no tax return filed, delinquent tax return, fraudulent return, willful attempt to evade or defeat tax). [11 USC § 523(a)(7)(A)]

Tax penalties are also discharged if they relate to a tax year more than three years before filing the bankruptcy petition. [11 USC § 523(a)(7)(B)]